- W4 form 2021 how to#

- W4 form 2021 update#

A new withholding form must also be completed when an employee’s state of residency changes or there is a change in their personal information affecting withholding.If a state withholding form isn’t submitted the university will withhold DC taxes at the maximum allowable rate.

Email the completed form to using your GWU email address.

In addition to Form W4, all employees are required to complete the appropriate state tax withholding form at the time of hire which can be found in Payroll Forms. You can use these W4 Address Update Instructions (PDF) which can also be found in Employee Self Service.

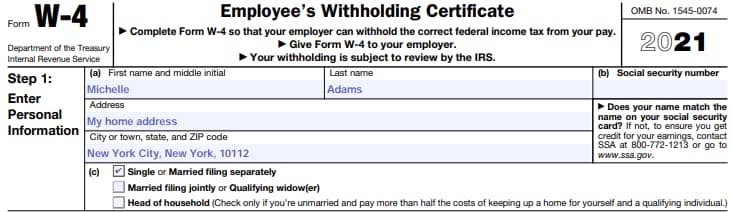

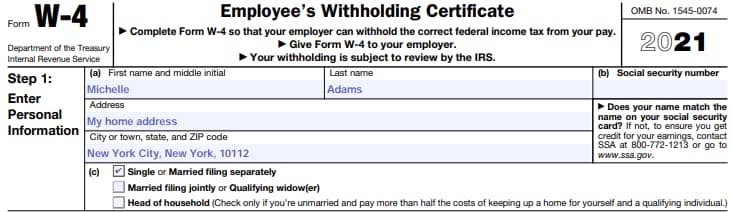

Changes to address information can be made at any time through GWeb. For payroll and benefit purposes, it is important that GW has a current record of all faculty and staff addresses. Instructions on how to change address information and W-4 Withholding information using GWeb can be found online in Employee Self Service. Form W-4 address information will be used for payroll and benefit purposes. It is important to keep your information current. Employees are responsible for maintaining the accuracy of personal information to include their address and withholding information. Please consult your tax advisor or the Internal Revenue Service (IRS) (telephone: 80) for assistance.įorm W-4 (PDF), Employee Withholding Certificate, is required so that the university can withhold the correct amount of Federal income tax from employees' pay. Payroll Services, Tax Department, and Student Employment are not able to provide tax advice and are limited in the amount of help staff can give in filling out forms.Failure to do so will result in taxes being withheld at the single standard rate.

Employees who qualify to claim exempt from federal withholding must renew their exemption status each year by completing and sending a new Form W-4 (PDF) to Payroll Services using these Renewing Federal Withholding Tax Exemption Instructions (PDF) also found in Employee Self Service, no later than February 15. Employees who change their state of residence must update their information using these Changing Residency- State Withholding Instructions (PDF).

Employees who qualify to claim exempt from federal withholding must renew their exemption status each year by completing and sending a new Form W-4 (PDF) to Payroll Services using these Renewing Federal Withholding Tax Exemption Instructions (PDF) also found in Employee Self Service, no later than February 15. Employees who change their state of residence must update their information using these Changing Residency- State Withholding Instructions (PDF).

address changes, changes in the number of exemptions).

Notifying Payroll Services by completing new tax withholding forms when there are changes in their tax status (i.e. Email the completed form to using your GWU email address or you can complete the appropriate State Withholding Certificate for Virginia, Maryland, and DC using these VA-MD-DC Inital State Withholding set up Instructions (PDF) through GWeb. Complete the appropriate state tax withholding form at the time of hire which can be found in Payroll Forms. Complete a Form W-4 (PDF). You may complete the form and email it to using your GWU email address or use the Federal Withholding Update Instructions (PDF) for federal tax withholding through GWeb. More information can be found here on the W-2 Form Page. Providing each employee an annual W-2 no later than January 31. Providing taxable wages and taxes withheld information on each employee to federal and state jurisdictions. Remitting taxes withheld in a timely manner in accordance with published federal and state guidelines. Withholding federal, FICA, and state taxes from employee’s wages. The university and each employee have responsibilities in this process.

The university is responsible for withholding federal and state taxes from all employees’ wages and reporting all taxable wages and taxes withheld to the Internal Revenue Service (Social Security Administration) and to the appropriate state. residents for tax purposes should contact the university’s tax department prior to completing tax withholding forms.

0 kommentar(er)

0 kommentar(er)